The smart Trick of Payday Direct Loans That Nobody is Discussing

Wiki Article

The Basic Principles Of New Direct Loans

Table of Contents9 Simple Techniques For Direct Payday LoansNew Payday Loans Fundamentals ExplainedHow New Payday Loans can Save You Time, Stress, and Money.Payday Check Loans Fundamentals Explained

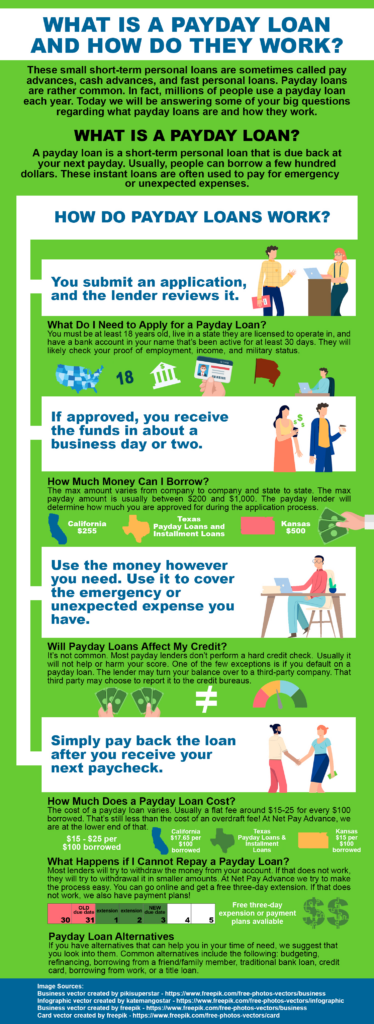

One is that numerous people who resort to payday advance loan do not have various other funding alternatives. They might have inadequate credit score or no revenue, which can prevent them from getting a personal loan with far better terms. One more reason may be an absence of expertise concerning or worry of options. As an example, some individuals may not fit asking relative or friends for help.

Some states, including Nevada and New Mexico, additionally limit each payday funding to 25% of the borrower's monthly revenue - Direct Payday Loans. For the 32 states that do allow cash advance financing, the expense of the car loan, fees and the optimum car loan quantity are capped.: 37 states have certain laws that permit cash advance financing.

Some Known Details About Check Cash Payday Loans

07. If the financing term were one year, you would multiply that out for a complete yearand loaning $100 would cost you $391. Your lending institution needs to reveal the APR before you accept the lending. While it's typical to see an APR of 400% or higher, some payday advance have lugged APRs as high as 1,900%.Some payday lenders will certainly use a rollover or renew feature when allowed by state law. If the lending is set to be due soon, the lending institution allows the old finance equilibrium due to roll over into a new financing or will certainly renew the existing financing once more.

This provides the debtor even more time to repay the car loan as well as accomplish their agreement. It also suggests racking up huge charges if they continue in the cycle.

That claimed, they can appear on your credit record if the funding comes to be overdue as well as the lending institution sells your account to a collection agency. When a debt collector acquisitions the overdue account, it has the choice to report it as a collection account to the credit report reporting bureaus, which could harm your credit history.

Facts About Check Cash Payday Loans Revealed

They additionally have a tendency to provide longer settlement terms, giving you more breathing area. Because it commonly uses a lower rate of interest rate and longer repayment term, a combination car loan can have a lower monthly settlement to aid you manage your debt repayment (http://peterjackson.mee.nu/do_you_ever_have_a_dream#c1120).Not all states allow payday borrowing, however those that do require cash advance lending institutions to be licensed. If a payday advance is made by an unlicensed lender, the car loan is taken into consideration void. This implies that the loan provider doesn't have the right to gather or call for the customer to settle the payday loan.Each state has various laws relating to payday advance, consisting of whether they're offered via a store payday loan provider or online.

A cash advance can address an urgent requirement for money in an emergency situation. Due to the fact that these fundings usually have a high APR, if you can't pay it back on time, you could obtain caught in a vicious cycle of debt. Base line: It's essential to take into consideration all your alternatives before approaching a cash advance lending institution.

Here are a few alternatives that might meet your demands as well as save you money. Some personal loan providers specialize in working with people with bad credit history. Whether you need to cover some standard expenses, cover an emergency or settle debt, you can usually obtain the cash money you require. As well as while your rates of interest will be greater than on various other individual finances, they're a lot reduced than what you'll get with a payday advance loan.

The Best Strategy To Use For Check Cash Payday Loans

And if you have negative credit rating, make certain to inspect your credit rating as well as record to establish which areas need your interest. In many cases, there could be erroneous have a peek at this site information that can improve your credit history if eliminated. Whatever you do, take into consideration methods you can boost your credit report so that you'll have far better as well as more budget-friendly borrowing alternatives in the future. https://docs.google.com/spreadsheets/d/1sk5TbUPmCuagNaT3QorDMhzytBt_oCIGGJZ7-FFsYZE/edit?usp=sharing.

Cash money advances are typically for two-to-four week terms. Debtors with credit troubles need to look for credit rating therapy.

Cash loan based on applicable lending institution's terms and also problems. * Same day funds offered only to client that apply at an Allied branch area. * Energetic checking account open for a minimum of thirty day (Direct Payday Loans). ** Transunion Credit, View Control panel is a 3rd party provided service. The product has not been changed or confirmed by Allied Cash loan.

Report this wiki page